Whether it’s a rust bucket or luxury four-door…

…your car is probably one of the most important/priciest things you own. Yet instead of guarding it with your life, you drive it at high speeds on an obstacle course full of unpredictable hazards and bad drivers. And like it’s no big deal. Crazy, right?

Since most drivers don’t bubble wrap their cars, car insurance is the most logical AND practical way to protect your vehicle. Our independent agents will walk you through a sweet selection of policy options to make sure you have the right coverage.

So what is car insurance? In short, it’s a contract between you and an insurance company. The insurer will help you recover financially from a number of scenarios that involve bad things happening to or caused by your car. Bad things can range from medical expenses to roadside assistance.

Why Do I Need Car Insurance?

In almost every state, it’s illegal to drive without car insurance. Every state has a minimum of liability coverage that is legally required. If you don’t have it, you could be fined. If you make a habit of getting caught without it, you could end up in jail.

The other good reason to have car insurance is consistency. It’s easier to pay monthly or quarterly premiums than to swallow the sudden cost of a bad accident. Unless you have an emergency stash of cash lying around, you should get yourself covered.

What Does Car Insurance Cover?

Car insurance covers your car, other people’s cars, the people inside the cars and the people around the cars (such as pedestrians and bikers). It really depends on the type(s) of coverage you have.

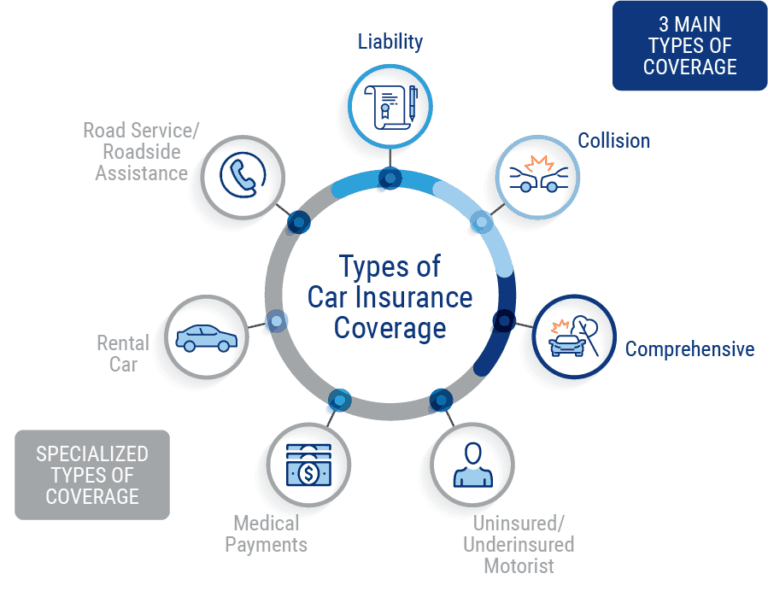

There are three main auto insurance coverage types—liability, collision and comprehensive. There are also a number of specialized extras available. Here’s an overview of what you can expect from each:

- Liability: This is the legal minimum of coverage—the other types are recommended, but not required. It covers your medical expenses (up to a point). If you’re at fault for an accident, it also covers the other driver’s medical expenses and car repairs. It does not cover repairs to your car.

- Collision: This covers repairs to your car in case of a collision with another vehicle or inanimate object, like a mailbox.

- Comprehensive: This covers everything else that can happen to your car: fire, wild animal collisions, riots and even missiles. It’s more accurately called “other than collision.”

Other options for more extensive coverage:

- Uninsured/Underinsured motorist: This covers medical or repair expenses that are more expensive than what the other person’s insurance covers. (For example, if they’re driving uninsured—illegally—or if they carry only the cheapest coverage.)

- Medical payments: This covers medical bills that go over what your liability insurance covers. If you don’t have health insurance, this is especially important.

- Rental car: This covers rental car costs while your car is being repaired after an accident.

- Road service/Roadside assistance: This covers emergency tows, battery jump starts and other roadside mishaps.

What Types of Car Insurance Coverage Do I Really Need?

It depends on your car’s value and how much you need your car. If you drive an old rust bucket that would be cheaper to replace than repair, you probably only need liability. (Because your premiums could be higher than actual repair costs.)

On the other hand, if you absolutely must have your car for work, dropping off your kids, or other mission-critical tasks, consider adding the other types (especially rental car coverage). They’ll help you cover bills and other expenses to get you back on the road.

Let The Pruitt Agency help you find the right auto policy for your family.