Your home isn’t just a structure made of beams and walls…

…it’s a magical place where you can binge-watch guilty-pleasure TV shows in a tattered bathrobe and eat ice cream for dinner without being judged. It’s your happy place, and it needs to be protected. The Pruitt Agency carries the burden of searching high and low and won’t stop until they find the homeowners coverage that will keep your carefree sanctuary secure.

What Does Homeowners Insurance Cover?

To put it simply, homeowners insurance is designed to repair, replace or recover the value of what you currently have (under coverage) if it’s damaged due to any number of causes.

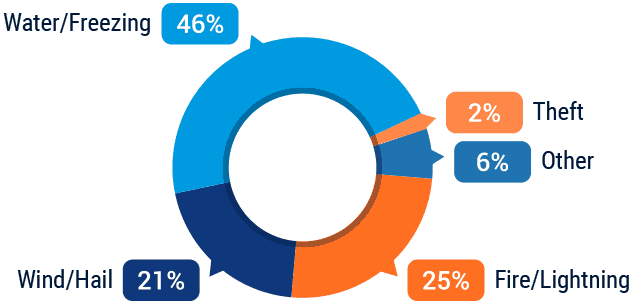

Types of Claims and Cause of Damage

- Property Damage – This is by far the biggest claim maker, which includes damage to your house and any structures on your property due to water, fire and severe storms among others.

- Natural Disasters – Homewreckers like floods and earthquakes are usually not covered by basic plans, meaning, you’ll need added coverage or a separate policy to keep your goodies protected.

- Standard Home Liability – This will cover you financially if someone is injured or their personal belongings are damaged while on your property.

- Extra Money for Living – If your house is too messed up to live in while it’s being repaired or rebuilt, most policies will pay for a hotel and other living expenses, like groceries.

- Personal Property Coverage (AKA your stuff) – This will depend on the policy. Items like furniture may only be covered up to a depreciated value, but stuff like your bling might not have any coverage and will need additional insurance.

Is Homeowners Insurance Mandatory?

Homeowners insurance isn’t required by law, but most lenders will be sticklers and will require a policy in order to give you a loan. At a minimum, they’ll want your policy to cover or exceed the amount you owe on the loan.

What’s So Great About working with an Independent Agent Like The Pruitt Agency?

It’s simple. Literally. Independent agents simplify the process by shopping and comparing home insurance quotes for you. Not only that, they’ll cut the jargon and clarify the fine print so you know exactly what you’re getting.

Percent of People Who Understand Their Insurance Coverage

Plus, independent agents work for YOU and not one insurance provider. Actually, they’re the only agents who can check policies from multiple carriers to find the right coverage at the best price.

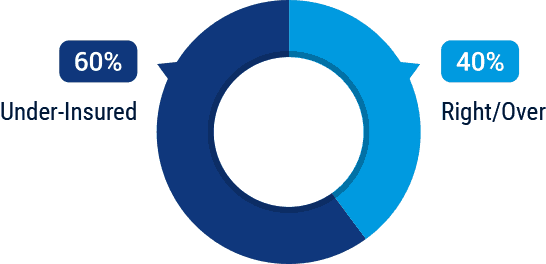

Percentage of Homeowners Who Are Under-insured

Most importantly, they’ll be there to help you when claim time comes. The outcome of home insurance claims can be strongly impacted by how the process is approached and handled.

How to Make Sure You’re Adequately Covered

Many homeowners think they’re fully covered. Unfortunately they’re not, and figuring this out when it’s claim time can be infuriating. Finding the right coverage depends on a number of things, from crime rates to wildfires in your area. Here are several hacks to help you.

Three Home Insurance Hacks

- Add an umbrella policy to increase coverage by up to $1 million or more.

- Protect higher-value items like jewelry and art through “riders” or “endorsements.”

- Get replacement cost home insurance instead of “actual cash value,” which only covers the current depreciated value.